Before you file your individual tax return, it is important to consider the benefits of doing so online. If you are looking for an affordable and efficient way to handle your taxes, then using online service is the best option for you.

The cost of filing one's own tax return can be prohibitively expensive; this is why many people choose not to do it themselves and instead hire a professional accountant. To make matters worse, there are often mistakes made on these forms which lead to more problems down the line when they get audited by the government.

Are you looking for a way to file your own taxes? You might be surprised at how easy it is with the right tools. There are many tax filing websites that offer services for an affordable price. Here, we'll take a look at some of the best options available!

Ultimate List of the Best Cheap Individual Tax Returns Online Australia

Tax Window - Individual Tax Returns Online Australia

0401 117 311

Tax Window employs an award-winning approach to taxation, setting them apart from typical accounting firms. Their comprehensive services extend beyond the scope of traditional tax agents, offering expertise in various financial areas such as investment accounting and business enhancement.

Unlike many tax agents who charge exorbitant fees for their services, Tax Window takes a different approach. They believe in simplifying the taxation process, providing clients with understandable solutions that are tailored to their specific needs. Moreover, Tax Window stands out by offering industry-leading fees for its exceptional services.

One of the key aspects of Tax Window's service is its focus on delivering personalised tax strategies to each client. As a boutique tax practice, their team of tax agents pays special attention to individual clients, ensuring that their tax strategies are carefully crafted to minimise tax payments.

For those seeking investment planning assistance, Tax Window is a reliable partner. They possess unique insights into the Australian tax code, allowing them to develop strategies that keep their clients ahead in the financial game.

Business owners can also benefit significantly from Tax Window's expertise. The team understands the challenges of managing a business and the burden of compliance-related tasks. By entrusting Tax Window with their accounting and taxation needs, entrepreneurs can free themselves from the hassle of number crunching and focus on the growth and success of their ventures.

Tax Window's award-winning approach to taxation goes beyond the norm, offering exceptional services that cater to the diverse financial needs of its clients. Their dedication to providing understandable solutions at competitive fees sets them apart as a reliable and trusted partner in the complex world of taxation and financial management.

Tax Warehouse - Individual Tax Returns Online Australia

0407 418 209

Save valuable time and money

Lodging your tax online can be done at any time, from the comfort of your home. We pride ourselves on being honest and transparent, so you rest assured you won’t be hit with any hidden costs or hefty fees.

The Online Tax Accountants You Can Trust in Australia

Do you dread completing your tax return every year? Well, now you don’t have to! Here at Tax Warehouse, we make the process of submitting your tax return easier than ever, we do it for you!

Our service is fast and simple, allowing you to find an experienced tax agent online and have your tax refund completed and processed as quickly as possible and it can all be done from your mobile phone.

The tax agents at Tax Warehouse submit your tax return online for you.

Their proven experience in claiming the most deductions that return the highest possible tax refund based on your industry. We give you the confidence knowing your return is in the safe hands of fully qualified and registered tax agents. We maximise your return amounts and minimise the work on your end, so you don’t have to dread tax season any longer, and can use that tax refund money a little sooner!

ITP Accounting Professionals Australia

1800 367 487

Brighton is a stunning city that is teeming with activity and thrilling discoveries. But, it can be a little challenging to appreciate the city you know and love if you're drowning in taxes. Our seasoned accountants are aware of where to go for all the information required to obtain the proper tax deductions and the tax returns you are due.

The organisation has more than 50 years of experience providing financial services to workers and business owners that require further assistance in setting up their budgets and accounting departments. In other words, we ensure that all the numbers match without causing any hassles.

Austax Individual Tax Returns Online Australia

07 4725 2384

Individual Taxation And Personal Services

We make it simple regardless of who you are, your profession, or your circumstance. We are the largest preparers of individual tax returns in North Queensland, and our professional and experienced consultants are dedicated to taking the worry out of complying with your tax obligations and, of course, achieving the best possible outcome.

Personalised Tax Services Australia

08 8271 4061

At Customized Tax Services, we are dedicated to providing taxation and business guidance at competitive rates on a personal, easily understandable level.

We are committed to providing a level of service that will exceed your expectations whilst helping you. We will handle your situation professionally, efficiently and with empathy. No matter how complex your return is, no matter how old your return is, no matter how good or bad you may feel about your situation, we will help you. We explain the tax laws that apply to you in a way that is easy to understand and can provide a free estimate prior to the commencement of any work.

We provide a level of service that will exceed your expectations whilst helping you. We handle your situation professionally, efficiently and with empathy.

Ex-Pats and Non-Residents

We have prepared and lodged many tax returns for both Ex-Pats and Non-Residents.

We can prepare and lodge your income tax return if you are overseas for any length of time. We can prepare and lodge your income tax return to ensure you meet the Australian Taxation Office obligations if you are a Non-resident on a working holiday, temporary work Visa or short term international transfer.

Multiple Income Tax Returns

We have helped many clients file multiple income tax returns, with some filing for up to ten years. This has been a huge relief for these clients, and in many cases, a refund has been issued.

Number Wise Individual Tax Returns Online Australia

1300 936 656

At numberwise, we think that by helping our clients succeed, we also prosper. Numberwise has worked to assist businesses, their owners, and anyone seeking knowledgeable guidance with tax and financial accounting for more than 30 years.

Our timely advice, expert tax and accounting services, and effective planning enable you to succeed while maximising value for you and your company.

Our approach begins with establishing a trusted relationship to understand the motivating factors that make you and your business unique. Then, equipped with that understanding, we work to address your immediate challenges and objectives while also focusing on achieving your long-term goals. Success doesn't happen by accident.It is the result of hard work, proactive planning, strategic execution, and keeping an eye on the future. That's why at numbers, the phrase "wise with numbers" isn't just a tagline; we live and breathe that every day.

Tax Refund On The Spot Australia

1300 768 284

Staffs at Tax Refund on the spot are qualified accountants and are experienced in handling all tax matters. Our objective is to maximise your deductions and rebates and gey you the maximum tax refund. We also offer a unique service of providing same day tax refunds.

H & R Block Individual Tax Returns Online Australia

13 23 25

We have been Australia's leading taxation specialists for more than 50 years because we are fascinated by statistics and consistently deliver exceptional results.

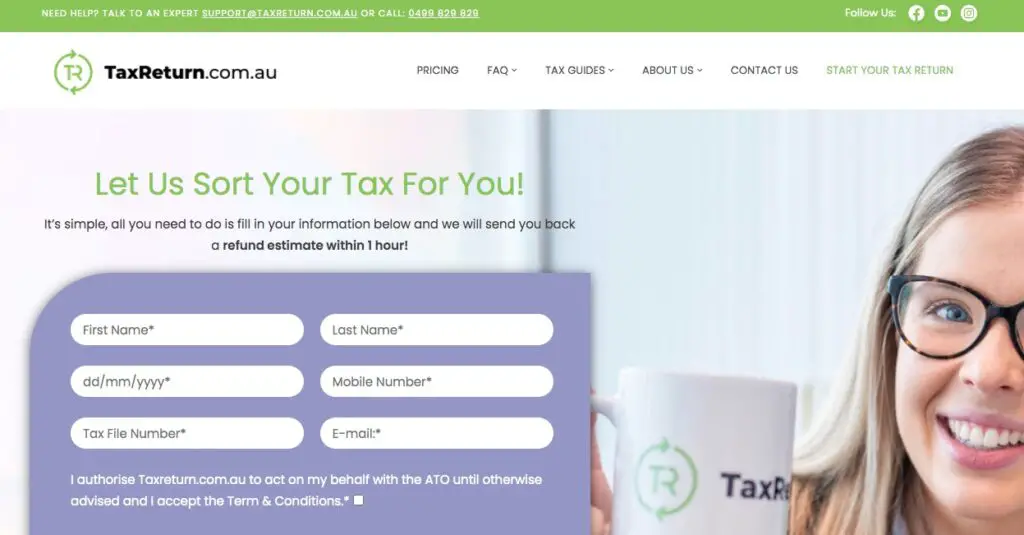

Tax Return Australia

0499 829 829

Many people are prone to filing their tax returns quickly since it takes time. When you utilise TaxReturn.com.au, our goal is to assist you in providing accurate information and disclosing all necessary income. You can always make deductions in this way and receive your dues.

With our assistance, you can finish your tax return in just a few minutes, and since you can access your account from anywhere using a laptop or smartphone, you can save your tax return and return to it whenever you choose. On average, Australians take hours to days to complete their tax returns.

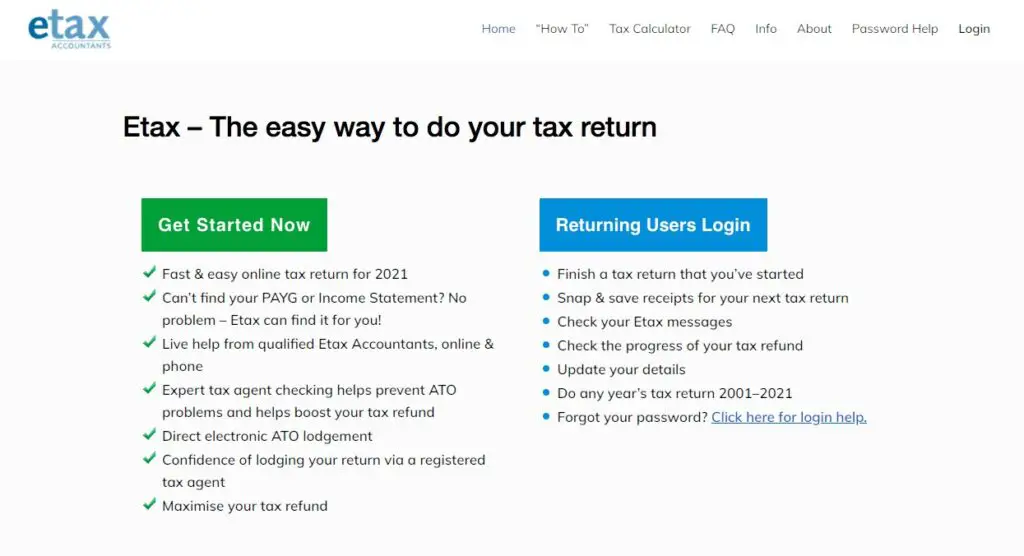

ETax Accountants Australia

1300 693 829

What's the best way to do my taxes?

A team of tax professionals and software specialists from Etax is on hand around-the-clock to streamline your tax return and enhance service and support. Based on the kind, considerate input we get from Etax customers, we update and enhance Etax each year. Every hour, thousands of people participate in the Etax survey, and your insightful comments have improved Etax.

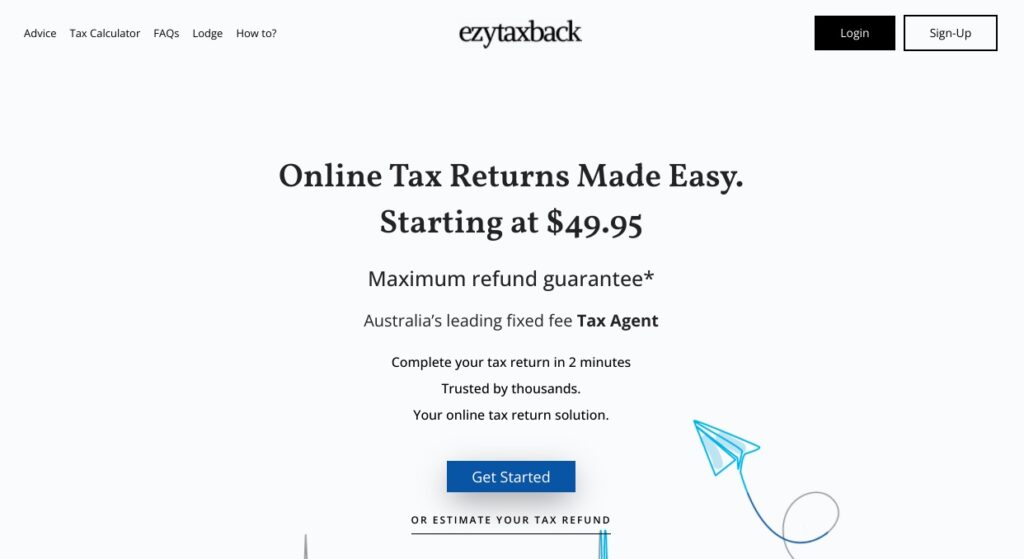

Ezy Tax Back Australia

How does our process work? Maximum refund guarantee!

We promise a maximum refund whether you join up for a yearly, one-time, or our rapid online tax return lodgement service. Our CPA accountants will begin processing your return as soon as you submit your form. To ensure we are maximising your eligible legal tax deductions, they will verify that all of your information is accurate and ask questions.

For one financial year, it applies to Australian Individual Income Tax Returns. We don't impose additional fees for rental property, foreign income, or other supplemental schedules, in contrast to our rivals. Your online tax return will cost you one set amount.

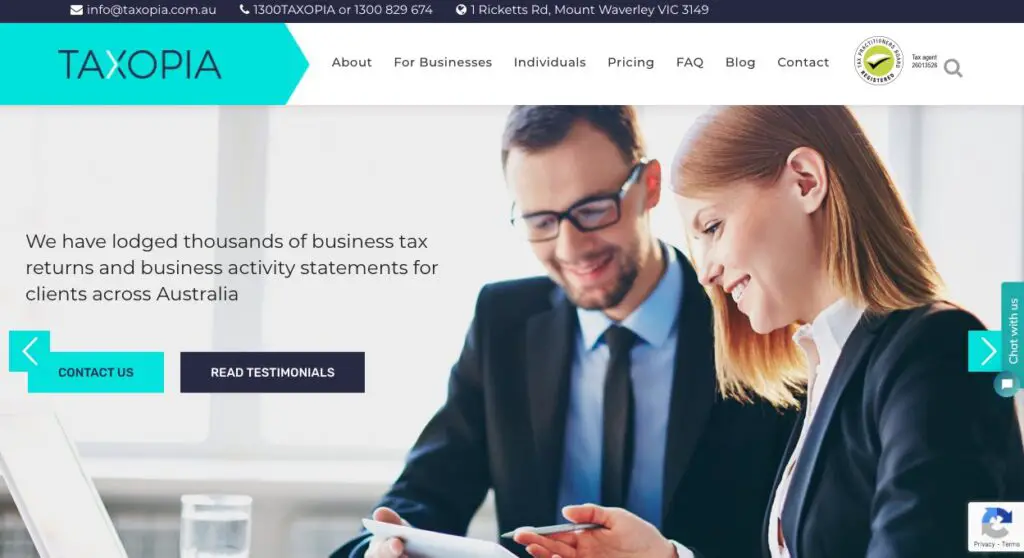

Taxopia Individual Tax Returns Online Australia

1300 829 674

Professional Accountants & Registered Tax Agents

Financial journals like the Australian Financial Review, BRW, and the Flying Solo Small Business Forum have previously published our tax and business commentary. We have filed numerous business tax returns, business activity statements, company tax returns, and trust tax returns. Our products are of the highest quality and provide unrivalled value to Australian small and microbusinesses.

Based In Melbourne Servicing All Of Australia

We employ cutting-edge methods to guarantee the security and confidentiality of your private company or trust tax information. So, it makes no difference where your company is located—in Brisbane, Sydney, Perth, Adelaide, Melbourne, or any other location in between. Great tax accountant solutions are available from Taxopia for all Australian areas.

Tax Ware House Individual Tax Returns Online Australia

407418209

The Online Tax Accountants You Can Trust in Australia

Do you dread completing your tax return every year? Well, now you don't have to! Here at Tax Warehouse, we make the process of submitting your tax return easier than ever, and we do it for you!

Our service is fast and simple, allowing you to find an experienced tax agent online and have your tax refund completed and processed as quickly as possible, and it can all be done from your mobile phone.

No matter who you are or what industry you work in, our online tax advice is suited to you. We cater to a wide range of people, from contractors and those in the construction and trades industries and corporate and creative professionals, retail employees, rural workers, school teachers, office workers, social workers, or anybody required to lodge an Australian Tax Return. Our online tax accountants can help you maximise your return in just a few minutes, regardless of where you are in Australia—whether you're in Adelaide, Mildura, Melbourne, Sydney, Brisbane, Perth, Darwin, Gold Coast, Cairns, Townsville, Hobart, Shepparton, Swan Hill, Portland, Sale, Toowoomba, Broome, or another city. Also, the tax warehouse is aware of the tax deductions that are available.

One-Stop Tax Australia

(02) 8373 5917

Complete your online tax return with the help of a committed CPA tax accountant.

This is Neither an automated online tax return system or a Do It Yourself system. We take care of all the grunt work for you! At One Stop Tax, all returns are prepared EXCLUSIVELY by a dedicated CPA Tax Accountant to ensure you will get the maximum refund you are entitled to. Simply complete our short online tax return questionnaire with our help, and attach your tax records. The rest will be handled by us.

New Wave Individual Tax Returns Online Australia

(07) 55041999

Your Trusted Gold Coast Accountants.

We're not the standard dinosaur accountant. With the help of our outside-the-box accounting, advisory, and bookkeeping services, over 800 Gold Coast business owners and entrepreneurs have launched, expanded, and scaled their operations.

How much does your Accountant & Bookkeeper cost Your Business?

You can use this money to hire more staff, enhance your own bonus for all the hard work you've put in over the years, or invest more in marketing. You'd be able to lift a big weight off your shoulders in terms of being financially secure and feel like your business is finally moving forward.

Our Chartered Accountants & Business Advisors team will help you stop the stress & anxiety of trying to guess the financial position of your business with our 'outside the box strategies.

These are just a handful of successful client stories. We want to help you become one of them. How much is your current accountant costing you? If the answer is "Cheap", then I can guarantee that they're not putting in the time or effort to allow you to achieve these types of results. You may be missing out on thousands.

Online Tax Australia

(03) 9852 9051

Online Tax Australia is a family-owned business operated by three brothers (Brendan, Michael and Stephen).

Our team is highly qualified and well versed in what is required when lodging a tax return using an online service. We each have more than 20 years of experience in taxation, accounting, and business planning and management. We guarantee a qualified tax agent checks every single tax return submitted with us so that any questions or items requiring clarification are resolved before the return is formally lodged with the ATO.

There is no pressure to complete your tax return in one sitting. If you have questions or require additional information, simply click on the 'Save and Log Out option. You can come back to your return at a future time. This allows you to contact us to discuss any questions or collect any missing information before submitting your tax return.

Our tax agents will conduct a thorough review as soon as your return is sent in to us. We will get in touch with you personally if we have any questions or things that need clarification. Be assured that using our review service won't cost you anything more. The Australian Taxation Office receives your tax return after we have filed it (ATO).

Tax Today Individual Tax Returns Online Australia

1300 829 863

At Tax Today, you can purchase a professionally prepared tax return, after which your refund will be issued immediately away. Either a cashable check or a direct deposit to your bank account within an hour are options for receiving this.

We are called Tax Today for this reason. The majority of refunds are given at the time your tax return is filed. That moves nearly as quickly as an ATM.