Are you in the market for a new home but don't know where to start? Maybe you're not sure what kind of mortgage is right for you. Or maybe you've been burned by bad mortgage brokers in the past.

Here, we'll introduce you to some of the best mortgage brokers in Melbourne and detail why they're worth considering. We'll also provide some tips on how to find the right broker for your needs. So read on and get started on finding your dream home!

We've compiled a list of the best brokers in the city, based on customer feedback and our own experience.

Ultimate List of the Best Mortgage Brokers Melbourne

EWM Accountant - Mortage Brokers Melbourne

03 9568 5444

Why Choose Us?

As specialist taxation and advisory firm, we don’t force round pegs into square holes. We build our procedures to fit your firms specific requirements. Like to receive files by Dropbox®? We can do that.

Prefer to get old-fashioned correspondence by mail? Need bookkeeping or just payroll help in addition to accounting services? We can help. Need finance advice as well? Not a problem.

Background

EWM Accountants and Business Advisors are Chartered Accountants helping small businesses with their accounting, bookkeeping and taxation needs. Established more than 30 years ago, we are experts in helping small businesses and specialise is the construction, investment, medical, dental and manufacturing industries. Based in busy Oakleigh in Melbourne, the firm is made up of a group of expert accountants who bring a wealth of experience to help fulfil our vision.

Our Values

- Passion:

We feel dedicated, excited and motivated about what we do, seeking joy, meaning and significance in our work. We love what we do! - Integrity:

In all our pursuits, we act with honesty, seeking to be truthful and open. - Enrichment:

We build lifelong knowledge and ability through education, mentorship and work experience. - Loyalty:

We embrace a sense of commitment, connection and dedication to our clients. - Ownership:

We are proactive, dependable and responsible in all aspects of client service. - Teamwork:

True success comes from the interdependence of individuals working together as a team. We value listening, understanding and mutual collaboration.

Victorian Mortgage Group Melbourne

(03) 8600 7900

Experience

Our team of professionals share a wealth of experience across all areas of banking and finance. You will benefit from our ability to anticipate, comprehend, and resolve any problems that may arise during the lending process. We are more than willing to assist you, having financed over 30,000 homes to date.

Approach

VMG listens to your story. We recognize that each individual faces unique challenges, and we cultivate long-term relationships with our clients to ensure they receive the personalized care they deserve.

Why Choose Vmg?

Real people face real problems and everyone has a different set of circumstances. We’re interested in understanding your story and making a tailored recommendation to fit your needs.

Competitive Interests Rates

Offering some of the best-priced products on the market, we are able to match people with a product from our range to suit their circumstances.

Professional Experience

We understand that no situation is black and white. And when we assess your suitability for a loan, we take your personal situation into account so as to arrive at the best option for you. To get started, complete our online form and one of our qualified advisers will be in touch.

Lime Financial Mortgage Broker Melbourne

1300 724 088

What’s the next step in your financial journey?

Are you buying your first home, making a property investment, growing your business, or looking to consolidate your debts? In the world of finance, you need to know what move to make next, how to take that step, and who you can trust to give you the best advice.

Since 2005, we have been your mortgage and finance specialists. Our team provides independent, targeted advice to help you take your next step, as well as offering long-term financial planning services. Partnering with big banks, credit unions, regional banks, wholesale funders, and online lenders, we have the access and expertise to assist residential and commercial borrowers from all walks of life.

Whether you’re a sole trader, you run your own business, or you earn a wage, our team is here to put you on a path to financial success. We will recommend the right product, take care of all the paperwork, and deliver a complete financial solution.

Frequently Asked Questions About Mortgage Brokers

Tundra Mortgage Brokers Melbourne

1300 447 010

Tundra Mortgage Brokers Melbourne

We are a boutique mortgage broker serving Melbourne's Eastern Suburbs, including Croydon, Lilydale, Ringwood, and Mitcham.

Tundra Mortgage Brokers caters to First Home Buyers, as well those looking to Refinance their current Loans.

We specialise in offering you the right Home Loan for your situation, as we are not owned by a Bank! We have access to a large range of lenders and can therefore find you competitive interest rates and mortgages with the right features.

What Can We Do?

Unlike our competition we prefer to offer a full range of services, without sacrificing on the quality of each feature.

We accomplish this by keeping our knowledge current and up to date, as well as honing our existing skills. Instead of spreading our resources thinly across a variety of services, we choose to use our team's skill-sets to provide a superior level of understanding and expertise when assisting our clients.

This means that we can tailor our services to suit you, whether you’d like to stay one step ahead of the latest interest rates, take advantage of our lender relationships, or have our team take care of all correspondence, whilst minimising your stress in the process.

Home Loan Experts Mortgage Broker Melbourne

02 9194 1700

Why should you work with us as your mortgage broker?

We want to represent the very best of what it means to be a mortgage broker: delivering a high level of service and tailoring home loan solutions that make a difference to the lives of our clients.

We get tough loans approved

Our expertise is in helping customers who have unusual circumstances, even those that have been knocked back by a bank in the past. Where other brokers have failed, we regularly get approval from a reputable lender.

Get the right home loan for your needs

We take a holistic approach when assessing your financial situation and long-term goals to ensure that you get a home loan that’s right for you.

Get incredible interest rates

Because of the relationships we have with our panel of lenders, we’re able to negotiate a sharp interest rate based on the strength of your application.

Fast approval, easy process

We can help you navigate the often complex pre-approval and application process, helping you to achieve your dream of owning a home much easier and in much less time.

Intuitive Finance Mortgage Broker Melbourne

1300 342 505

Experience across a range of customer types

We work with a range of customers, from first home buyers, homeowners looking to upgrade, sophisticated investors with extensive property portfolios, Australian expatriates living and working overseas looking to establish a property portfolio in Australia and we have a particular focus on the self-employed who, despite the significant challenges in clearly establishing their capacity to maintain an investment, are comfortable with complex financial strategies and have an entrepreneurial, “can do” approach to their portfolios.

We put you first

There are documented goals for all of our customers, and we are committed and passionate about providing you with the best loan "experience" possible. We also keep you updated at every step of the loan process, including a post-settlement follow-up. We also ensure that we contact existing clients on an annual basis to review and assess an RP Data property report for your portfolio.

Mortgage Compare Plus Broker Melbourne

0412 110 11

Our values and philosophy are a reflection of the socially responsible company we aspire to be. We are a company which believes in performance with purpose and remain committed to our understanding that our financial position goes hand in hand with our social and charitable responsibility.

The Best Interests Duty, which took effect on 1 January 2021, legally obliges brokers to act in the best interests of their clients. This new law is on top of the National Consumer Credit Protection Act, which already regulates the conduct of brokers.

Entourage Mortgage Broker Melbourne

03 9421 1651

Who we are

Experience award-winning service from a team that thrives on listening to your needs. By listening and using our experience to ask the right questions, we’ll find the perfect fit — whether that’s a sparkling new home or the right loan to finance it. Our in-depth research on your behalf takes the guesswork out of financing property, understanding the legal aspects and applying the best strategic thinking.

Our clients don’t queue on hold for the bank. They make a call to someone who knows them better every year, someone who makes everything easier.

Why work with an Entourage mortgage broker?

Based on your unique financial circumstances, we offer impartial counsel. We communicate with all the lenders on your behalf, weigh the pros and cons of various possibilities, and present you with the best options to suit your needs, saving you time.

We can compare these many choices for you because we have access to more than 60 different lenders and institutions in Australia, as well as the research resources and expertise to do so. This means they are able to help guide you to find the right product for you, including taking into consideration your financial position, current lender credit policy, products and features.

Clark Finance Group - Mortgage Broker Melbourne

1300 366 670

Our Mission

To provide our clients with more choice, great rates, transparent advice and good old-fashioned personal service.

We do not believe our service ends with the settlement of your loan, but rather where our relationship begins. We aim to be your life long finance specialists by sharing your vision and helping you reach your goals faster.

Bspoke Mortgage Broker Melbourne

1300 386 630

Financial decisions are difficult to make at the best of times. These decisions are made even harder when you don’t know where to start or who to trust. We listen to understand your individual situation, so we can provide solutions and options tailored to you.

Guiding you through the process and explaining the ‘why’ is at the heart of what we do. We want to educate, guide and support you to make the best financial decisions, not just today, but with your future financial goals in mind.

We consider every application as one of our own, we want the very best for you because we care. We believe that financial decisions are not just a point in time, but a journey. We want to be on this journey with you, today, tomorrow and into the future.

Our Purpose

We know that everyone is different. No two people are alike and no two situations are the same. Whether it’s buying your first home; growing your investment portfolio; refinancing your commercial premises; consolidating your existing debts; or purchasing a vehicle for personal or business use, we’ll tailor a solution that works specifically for you.

Soren Financial Mortgage Broker Melbourne

1300 899 819

Lenders and brokers will always try to sell you the easiest and quickest product they can. It is their bread and butter however it is not always the right choice. There are lots of unique products available that experienced investors are aware of but the general public will never hear about, and the only reason for this is awareness/ education. Crazy right?

With the recent financial industry shakeup in 2019, a lot of positive changes have happened however what has also occurred is a flat structure when it came to mortgage broker payments. What this means to you as the client, is that your broker is paid the same no matter what they offer and hence this causes what I call the “Vanilla Effect”. There is no immediate financial benefit for a broker to look deeper into your individual position and to try to find you the right product and the right lender. More often than not you will be pushed towards a lender the broker is comfortable using.

Build your Legacy with Soren Financial.

We have specialised services to help clients through every stage of the buying process, whether you are a first home buyers looking to navigate the available grants, or a professional investor looking to make a purchase via your self-managed super fund or family trust.

Trusted Mortgage Broker Melbourne

0425 792 325

“I place your interests first in my dealings with you. In doing so, I will ensure I recommend a loan which is appropriate (in terms of size and structure), is affordable, applied for in a compliant manner and meets your set of objectives at the time of seeking the loan.”

We promise to provide a service based on integrity and a genuine interest for our clients in assisting them with all their financial needs by utilising our resources of financial and insurance products.

After your loan has settled – we don’t just disappear! We are still around to answer your questions and keep you up to date with what is happening in the property and home loan market.

Why Choose Us?

Sifting through the different lending requirements, the changing grants and bonuses, and the complex terminology and fine print can be overwhelming.

When you put this process in our hands, we bring our years of experience – and many contacts – to the task so you can find the right product without going through the hassle yourself. This saves you time and reduces your risk of being declined, as we know which lenders’ credit policies and restrictions will work in your situation.

Market Street Finance - Mortgage Broker Melbourne

1300 612 253

We work intently and in-depth with all our clients.

For businesses, this means we spend the time to understand their business from a financial and planning point of view. This helps us understand the current pain points and identify the areas we can help to grow.

For individuals, we look not only at the current funding requirements but future goals. This ensures any funding we put in place is appropriate now and in the future. For businesses and individuals, we have an annual review of all lending facilities to ensure they are still competitive and appropriate.

My Expert - Mortgage Broker Melbourne

1300 693 363

We know from more than 20 years of experience in the home loan and finance industry that making important financial decisions can be overwhelming, where emotions and stress levels can – and do – run high.

Our company was founded on the philosophy of removing the emotional stress from real estate transactions and empowering community wellbeing through industry-leading support and advice our clients can rely on. We still believe in this philosophy, which is why we are one of Australia's leading home loan brokers.

Expert advice to help you make the most important financial decisions of your life.

Making financial decisions – the right decisions – takes Expert knowledge and insight. We understand that as individuals, we need financial advice and solutions that are specific to our circumstances.

Vanquish Finance Group - Mortgage Broker Melbourne

0409 089 241

They were established in 2005 and have arranged thousands of home loans for thousands of clients ranging from first home buyers, clients wanting to refinance their existing home loan, or property investors entering the investment market for the first, second or third time.

We are committed to being part of our local community. We strongly focus on using technology to reduce our carbon footprint, making sustainable and balanced decisions that support positive social, economic, and environmental outcomes.

Sprint Finance - Mortgage Broker Melbourne

1300 547 252

Buying a house is likely to be one of the biggest purchases of your life. The process can be daunting and confusing, especially if you’re a first home buyer. So you shouldn’t put it in the hands of just any Mortgage Broker or Lending Specialist.

Sprint Finance is a mortgage brokerage firm that is entirely owned and run in Australia. Even though we have relationships with some of the biggest lenders in the nation, finding the best loans and lenders for you is our first priority. We are dedicated to finding a mortgage solution that offers flexibility for whatever life throws at you.

The process of purchasing a home should be an exciting time in your life. You've put in a lot of effort to get here. So it's time to buy your dream home. Our dedicated team will make the process of obtaining a home loan as simple as possible. We'll be with you every step of the way. Our Finance Specialists are available seven days a week to answer all your questions about mortgages and loans.

Guidance Mortgage Brokers Melbourne

guidancemortgagebrokers.com.au

0405 447 241

Why should you use a mortgage broker?

There are many good reasons why more than half of Australians now use a broker to secure a home loan. Probably the most important one is that we work for you, not the banks. We speak to you first to find out what you need, and then we use our knowledge of the market to better negotiate with the lenders. Then we get a range of options before we work out which one is right for you, not what’s right for the lenders.

Lending Specialists - Mortgage Broker Melbourne

03 9764 2646

The Lending Specialists advantage:

We have been in business for a long time and have years of experience; our brokers and staff are experienced; we have a proven track record; our values include being respectful, honest, supportive, professional, and tolerant; and we get things done (even the difficult deals), Making it happen is something we do on a daily basis; we have hundreds of industry connections and a diverse set of business, banking, financial, and negotiation skills. Our diversity allows us to resolve complex questions and find logical solutions, we are flexible and forward-thinking.The combined knowledge in our business is enormous, we have expert knowledge of your local area.

Lend A Loan - Mortgage Broker Melbourne

1300 861 463

Every single member of our mortgage broking team is ambitious, experienced and brings something unique to our finance company.

Every day in our Melbourne office, our passionate and dedicated finance and mortgage brokers come together with a few common goals and values: providing the best financial solutions to our valued customers and putting their best interests first.

The Lend A Loan Finance and Mortgage Brokers have access to over 45 residential and commercial banks and lenders, which allows them to assist you in choosing the right loan product for your exact financial requirement.

Own Home Loans - Mortgage Broker Melbourne

1300 721 342

Own Home Loans removes the guesswork from finding the right home loan and provides you with access to our mortgage finance expertise. Own, on the other hand, goes a step further, assisting you to Own Your Home, Own Your Life, and Own Your Future.

We empower and support you to reach your homeownership dream sooner than you thought possible!

Own Assist Makes Moving Easier At No Cost To You!

To save you time, stress and a whole lot of hard work, we created ‘Own Assist’, a free and convenient service that helps you pick and choose the plans and services you would like.

This is a complimentary service and means you don’t have to worry about organising anything! You will even be allocated your Moving Specialist to help you along the way.

Gilbees Mortgage Planning - Mortgage Broker Melbourne

03 9633 4625

Making a big purchase can be a daunting experience. There is always so much to consider when taking out a loan, whether refinancing, down-sizing, investing or buying your first home. That’s why it is vital to use an expert who understands the finance industry and can find you a competitive loan that suits your needs and lifestyle.

We aim to find you a loan that not only meets your requirements but exceeds your expectations in terms of rate, product and service. We believe in providing you with choice, and at Gilbees Mortgage Planning, we look forward to supporting you in your dream of owning your own home or investment property. Please read on to see how we can help you, or just visit our Contact Us page to get started today.

MoneyQuest - Mortgage Broker Melbourne

1300 886 435

Whether it be for your first home, upgrading to accommodate your growing family or empty nest syndrome has set in, and it’s time to downsize, we will help you compare simply and choose wisely. It's what we do!

Empower Wealth - Mortgage Broker Melbourne

1300 123 724

Saving for your first home, purchasing it, and then building on its wealth base, Superannuation, determining the best use of your household's surplus income, and building a multi-million dollar property portfolio... It is possible, but almost all of us require professional assistance.

Lucid Lending - Mortgage Broker Melbourne

03 7019 2415

We are passionate about helping you own your dream property.

From first home buyers to seasoned property investors, we partner with you to help secure the best deal possible. We ensure that you understand all the particulars of your loan, which makes your lending experience stress-free.

Your Loan Assist - Mortgage Broker Melbourne

1300 007 352

You're different.

We comprehend. Full-Time, Part-Time, Casual, and Contractor Employees. Self-Employed: Full Doc, Low Doc. It's Complicated: Where do I begin?

Your needs matter.

We make an effort. First Time Buyer BuildingConsolidating Debt

Melba Mortgage Broker Melbourne

0431720242

Loan Products & Programs

We have access to a large panel of residential and commercial lenders who offer a wide range of products. fixed & Variable rate home loans, Refinance with exclusive rebates and low rates, Bridging finance, first home buyer loans. house and land packages. Home Equity Line of Credit

Types of finance available

We can facilitate a solution for customers with varied needs, Owner-occupier or Investment loans, Self-employed customers. Professional offers for doctors, lawyers and accountants, commercial loans and Private lending, asset finance or car loans, customers with credit defaults and other issues

Entry Finance - Mortgage Broker Melbourne

1300 468 234

Our purpose is to work with you to safeguard your financial future and reach your financial goals. We have knowledge and experience with both mortgage and loan brokerage. This enables us to provide financing choices to assist you in reaching your financial objectives.

We believe in establishing long-term relationships by providing you with honest and realistic options. Our team will remove the jargon and communicate with you in plain English, allowing you to better understand your options and make the best investment decision.

ARG Finance - Mortgage Broker Melbourne

1300 511 235

We are a team of extremely talented, experienced and financially savvy individuals who are great at numbers and can help with any size or type of loan you are after.

ARG Finance is a full-service provider of financial solutions, not just another mortgage broker business.

The Australian Investment and Lending Centre - Mortgage Broker Melbourne

55 612 125 242

As with any financial strategy, the right loan structure depends on individual goals and circumstances, and getting the right advice is very important. At ALIC, we specialise in working with you to develop the most appropriate finance strategy and structure by talking with you and understanding your current financial situation and future goals.

To ensure these structures work, we work alongside your trusted advisors or give you access to ALIC’s trusted market specialists, including financial planners, wealth management/tax accountants, buyers’ advocates and other experts. The important thing is you have access to specialists to help and guide you through the process. Loans are arranged through some financiers, including all the major banks ANZ, Westpac, CBA, NAB and many other institutions, including Bank of Melbourne, Macquarie, and ING, to name a few.

Loan Market - Mortgage Broker Melbourne

0408 206 353

Does your home loan suit your needs? We understand that every client will have different needs and circumstances and pride ourselves in finding the right loan set-up for your specific situation.

We have over ten years of financial experience and have been through the many ebbs and flows of the Australian home loan market. We use our experience, expertise and knowledge to assist you in any financial situation, including finding the right first home loan, next home loan or investment loan.

Resolve Finance - Mortgage Broker Melbourne

1300 883 463

We're here to assist you make better decisions, offer options, and find solutions so that you and your family can live the best life possible.

We’re called Resolve because that’s what we do. We’re here to resolve the challenges home buyers, home builders, homeowners, renovators and investors face on the journey to whatever’s next.

Accession Finance - Mortgage Broker Melbourne

03 9397 2535

From our experience in the industry, there is no 'one size fits all' when it comes to financing. We have worked with self-employed clients, have a minimal deposit, are first home buyers, building a new home, and in each case, we have investigated the best option for their particular criteria.

In most cases, we are paid via a commission by the bank; we charge no additional fee to the client to find and arrange the personal finance for our clients.

Our Service Guarantee

To provide a service you can trust and an experience where you know you come first. Our quick response times, insightful knowledge of the industry and ability to find the right loan for our clients is where we know we stand out.

Loanscope - Mortgage Broker Melbourne

03 9988 5325

We have a team of Mortgage Brokers based in Melbourne. We set the standard for finance broking by delivering what we promise: quality service, expert advice and tailored loans at low, low rates.

We have access to hundreds of home loan packages and the expertise to find one that meets your current needs as well as your future financial goals. We can recommend reputable conveyancers, accountants, financial planners, and other professionals to supplement our services.

Why choose Loanscope?

We operate in your best interest – because what’s truly best for our clients is best for our future. Our repeat customers and referral-driven growth prove we’ve made the right choice.

As expert mortgage brokers with years of experience, we have access to hundreds of loan products you can choose from – whether you are investing for personal or business reasons. You get access to the full market spectrum, not just the over-advertised basics.

Mortgage Corp Broker Melbourne

3456 463 635

We specialise in helping successful full-time professionals buy 1 to 5 investment properties in 5 years [through smart financing], so they can have consistent passive income coming in before they retire and continue to live the life of their dreams even after retirement when others are downsizing, reducing expenses and living on a budget.

Without our help, successful professionals will not have a clear roadmap to starting and building a profitable property portfolio, will waste precious time (as much as ten years) not getting on the right path to financial freedom, or even worse, get the bad advice that will lead them to the path of endless stress, wasted time, money and opportunities.

Inovayt - Mortgage Broker Melbourne

1300 354 354

While running a successful mortgage company on their own, the founders saw a need to provide a more comprehensive solution to their clients. Inovayt Wealth was founded in 2012 to provide financial advice.

Innovate has since grown to over forty employees, opened four offices nationally, and introduced a commercial finance division to strengthen the offering to our clientele further.

Investors Mortgage Broker Melbourne

1300 468 463

Investors Mortgage has been assisting first-time home buyers and investors since 2007, with the goal of providing exceptional mortgage solutions to Australians. That mission is still a driving force today. Investors Mortgage has always sought out the most innovative and responsible lenders in the country. As a result, we are one of the most reputable mortgage brokers in the country.

Why we are one of the best in Australia:

We use the latest in mortgage processing technology to bring you the most up-to-date information.

Our financial products vary from simple to simply spectacular. We are experienced with both residential property purchases and commercial real estate purchases. We understand the needs of today’s investors, and if you are looking for your first home, we will help you finance the home of your dreams.

We provide you with the cheapest interest rates to give you the lowest mortgage payments. We provide you with the right tools like a Home loan repayment calculator so you can compare home loan interest rates in Australia. We provide our clients with a First home buyer guide and investment property purchase guide along with calculators to find your borrowing capacity to answer your basic questions like ‘How Much Can I borrow?

Opulent Finance - Mortgage Broker Melbourne

03 8838 3592

We are a friendly team that focuses on putting our customers’ needs first. We will go to extreme lengths to get the very best solution we can for our customers. That is why all of our customers recommend us to their family, friends and colleagues, and this is how we have grown over the years.

Our well-experienced team at Opulent is extremely proud of the over 98% customer retention rate. We are very proud of our industry awards but what we love the most is that when we engage with customers, we usually embark on a lifelong partnership, assisting them with their and their families financial matters for many years.

Our consultations are FREE to you and are not biased to any financial institutions in our panel. Finding the best-suited solutions for you is our primary focus. All our customers also benefit from our experience and expertise in accounting and taxation through Opulent accountants. We do offer the whole package to you.

Aussie - Mortgage Broker Melbourne

13 13 64

Big things originate from little beginnings. In 1992, "We'll Rescue You" meant a lot to us, and it still does almost 30 years later.

VDA Finance And Capital - Mortgage Broker Melbourne

1300 832 536

We recognise that each customer's situation is unique. We can provide customised loan comparisons and tailored lending solutions across our extensive panel of residential and commercial lenders. Our consultations are free of charge, and our services are also free of charge.

Mortgage Finesse - Broker Melbourne

3989 509 346

We have access to a range of loans at some of the best rates from more than thirty different lenders across Australia that can help you get to your financial goals sooner.

Customer service and helping clients is our thing. The relationships we have with our clients are ongoing. Our service continues beyond settlement which is probably why we see many of our clients return time and time.

Don't waste time going from bank to bank when we can sit down and find the best deal. Time is valuable. We understand. Save your time for yourself, and let us take care of your mortgage needs without the stress. It's what we do.

Mel Finance Services - Mortgage Broker Melbourne

1800 940 752

We are a team of highly experienced mortgage brokers dedicated to assisting our clients in obtaining the best loans at the most competitive rates. From first-time home buyers to retirees, we take a highly personalised approach to each client's property journey. Beyond home loans, we work with businesses and investors, providing a specialised service designed to provide the most recent industry insights and market advice.

First Home Buyers

We are aware that buying your first home is a thrilling yet frequently intimidating experience. The Mel Finance team guides first-time buyers in Melbourne through the process of purchasing a home and obtaining a mortgage. Move into the home of your dreams with a loan that suits you by working with our trusted mortgage brokers.

Our Focus Is You

Our mission is to offer Melbourne residents a seamless and stress-free service, helping them through the entire refinance, mortgage or loan process. Our clients' requirements come first, and we work hard to find them the greatest bargains.

Mortgage Broker Melbourne

mortgagebrokermelbourne.net.au

1800 111 626

Since 1999, we have been serving the Melbourne CBD and the surrounding suburbs. We are not a huge firm with a nationwide presence. We are a flexible, small Melbourne company that provides a mobile service or the option to meet at one of several handy CBD locations.

Our service is free.

Mortgage Brokers Melbourne do not impose any fees. We openly disclose to you that the lender you select pays us a commision. (There may be lender and government costs to pay.) We aim to save our clients money, taking the time to individually negotiate the best available rate rather than simply accepting the standard rate on offer.

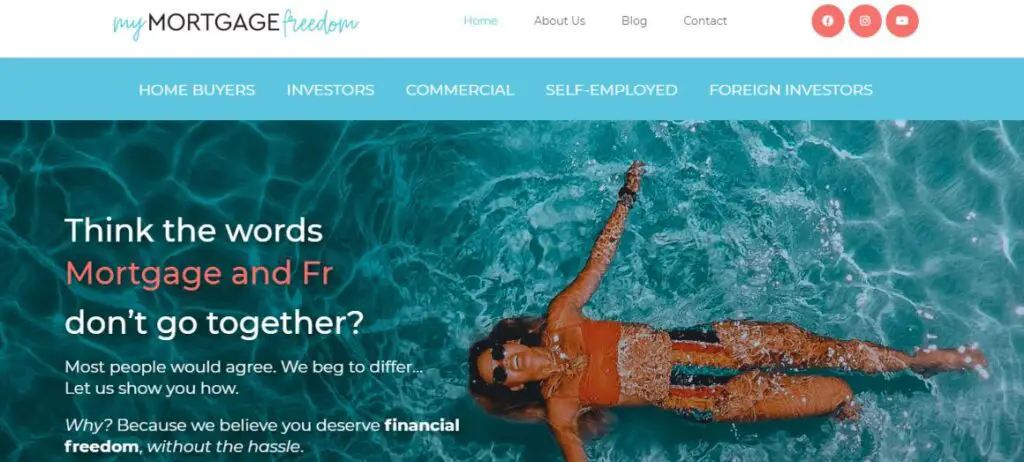

My Mortgage Freedom - Broker Melbourne

03 8256 1914

After your loan has settled, we don’t stop there. We have always touched base with our clients every year to make sure their loans are all still competitive and to check in to see if they have had any changes to their situation that needs attention. More importantly, interest rates tend to increase as the months and years pass, so we have put a stop to that ever happening again. My Mortgage Freedom customers have exclusive access to Australia’s first and only rate tracking technology.

This means that you can activate Rate Tracker on your home or investment loan to monitor your interest rate in real-time and protect you from any excessive interest rate hikes. This is all done automatically, and you will only ever be alerted if your interest rate has exceeded an acceptable level.

Fidget - Mortgage Broker Melbourne

1300 129 459

We’re the conduit between you and over 40 lenders, your wealth of knowledge and your hand-holding friends (not in a creepy way).

We’re Different

At Fidget JP Partners, it’s not just about putting you in touch with someone who will lend you money. Our Fidget mortgage brokerage team exists to make your refinancing or home buying process a smoother experience.

We’re Multiple-award-winners

Our nationally-award-winning mortgage brokerage is here to help explain your lender options and pick an awesome loan structure, along with our guru support team handling your loan application from start to finish.

Aspiire - Mortgage Broker Melbourne

1300 733 942

Home loans can be time-consuming and confusing. With various banks, offers, promotions, and credit criteria, it’s important to have a friendly expert to guide you to make an informed choice.

Get friendly home loan support.

Experience across home loans for investment and wealth creation, first home buyer mortgages, and business lending. Guidance for first home buyers,. Proactive and friendly support. Works for you, not the banks. Not aligned to a franchise or bank ownership

Blutin Finance - Mortgage Broker Melbourne

0435 916 755

As experienced professionals, we have all the skills needed to make your experience as seamless and comfortable as possible. We take the time to understand your financing needs, partner with you in understanding the various options and source the most competitive loan options for you.

Business Loan

Business owners or intending entrepreneurs can apply for a business loan and use the funds to make progressive changes, such as starting a business or expanding their current venture. If you are thinking of starting up a new business or expanding your current business and need access to funds, then the business loan is there to provide funding support.

If you already run a business but need extra cash to purchase equipment, hire staff, expand, renovate, purchase vehicles, obtain a commercial property, or do other activities, then the business loan is what you should apply for. Just like the home loan, you can select to pay a fixed or variable interest rate on your business loan.

Melbourne Mortgage Advice Broker

melbournemortgageadvice.com.au

1800 693 000

For over 20 years has provided leading home loan advice and guidance. As a former ANZ Bank Manager, Jon is an accomplished property finance expert and a fully qualified mortgage broker. On building long term client relationships and working relentlessly to help homeowners and investors succeed. With sensibly structured loans, good rates and great support, Jon has helped hundreds of people achieve their goals.

Owlbroker - Mortgage Broker Melbourne

0490 527 699

We serve Australia-wide. We are a Melbourne-based brokerage. We have a strong focus on delivering outstanding customer service and carefully considered strategic finance solutions.

At Owlbroker, you will be taken care of from beginning to end of the finance journey. We have the knowledge and expertise to find the right solution for your needs. It is our absolute passion to guide you every step of the way.

Proper Finance - Mortgage Broker Melbourne

03 8620 9099

Making a big purchase can be a daunting experience. There is always so much to consider when taking out a loan, whether refinancing, down-sizing, investing or buying your first home. That’s why it is vital to use an expert who understands the finance industry and can find you a competitive loan that suits your needs and lifestyle.

We aim to find you a loan that not only meets your requirements but exceeds your expectations in terms of rate, product and service. We believe in providing you with choice, and at Proper Finance, we look forward to supporting you in your dream of owning your own home or investment property. Please read on to see how we can help you, or just visit our Contact Us page to get started today.

Why Choose Us

Whether you are just starting with your first home or a seasoned investor, we are committed to providing you with the right home loan to meet your needs. We will discuss every aspect of your loan with you and ensure you understand the fine details – like competitive interest rates, offset facilities, unlimited additional deposits and redraw facilities. You can rely on us to provide you with customer service that you will value for the life of your loan and that we will continue to support you in achieving your future goals.